26+ Lvr calculator margin loan

Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee. Profit margin is the amount by which revenue from sales exceeds costs in a business usually expressed as a percentage.

2

For the most part the LVR can determine where you can borrow and how much you can borrow in some cases.

. Now you can determine the LVR percentage by dividing the loan amount by the property value. Most lenders have their. Rates subject to change.

When you have a margin loan youll probably be interested to know what the LVR is for the stocks you have in your portfolio. Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee. How to use the calculator.

This Loan to Value ratio calculator LVR will assist you in working out what the lending portion of your loan will be in relation to your deposit or down payment. 500000 600000 x. A loan is a contract between a borrower and a lender in which the borrower receives an amount of money principal that they are obligated to pay back in the future.

300000 loan 375000 value of a property x 100 80. LVR Calculator Loan to Value Ratio LVR is used by the lenders to measure of how risky a mortgage home loan is. Find out your COGS cost of goods sold.

927000 1000000 9270 LVR. Margin rates as low as 283. Enter your applicable margin lending fixed interest rate.

How to calculate profit margin. Find out your revenue how much you sell these goods for for example 50. It will affect the interest rate of your home loan as well.

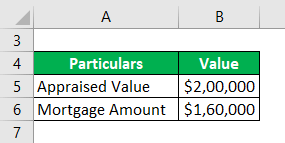

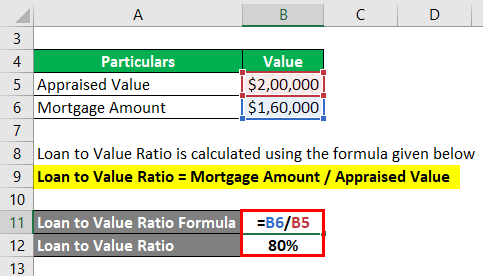

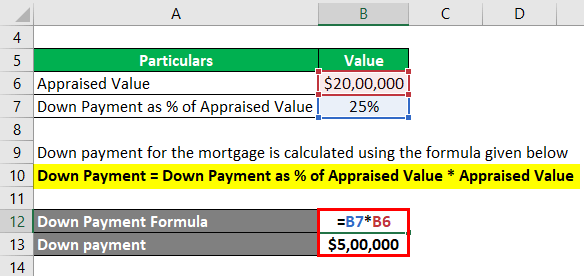

Based on this scenario LVR can be calculated using the formula below. In this example the loan amount of 300000 is divided by the property value of 375000 and. The amount that a margin lender is willing to lend is called the Loan-to-Value Ratio LVR.

It can also be calculated as net income divided. Its a percentage figure that. Step 1 - Using the Add Current Holding button add your current holdings andor cash to set your initial position.

For instance if you purchase a home for 500000 and put down a 100000 deposit you will be borrowing 400000. If youre not sure of your. Margin rates as low as 283.

Using a government-backed First Home Loan criteria applies Securing a loan that falls out of the LVR restrictions ie. 900000 1000000 90 LVR. Some lenders have limits on the capitalisation.

The higher your LVR the more risky the home loan would be. Rates subject to change. LVR stands for Loan to Value Ratio.

For example lets say that. 600000 - 100000 500000. In the 10 of loans a bank can lend to owner-occupiers.

Heres how to calculate it. Enter your loan balance the fixed period and the portion of your loan to be fixed. You can use the calculator to determine the maximum value of a specific stock you could purchase.

Step 3 - Use the. Loan to Value Calculator. Step 2 - Click on the What If tab from the top right-hand side.

The LVR will be calculated as follows. Enter the Available Funds from your loan account and the Loan to. For example if a Blue Chip company has a LVR or 70 and you wish to purchase 10000 worth of.

The Loan-to-Value Ratio is calculated by dividing the loan amount by the purchase price or valuation of the property youre buying expressed as a percentage.

2

2

Loan To Value Ratio Example Explanation With Excel Template

Loan To Value Ratio Example Explanation With Excel Template

Loan To Value Ratio Example Explanation With Excel Template

2

Loan To Value Ratio Example Explanation With Excel Template

2

2

Loan To Value Ratio Example Explanation With Excel Template